In the Shadow of the Head Frame

There’s an old adage that says to find a new mine, look in the shadow of the headframe of an old or existing mine. Four exploration projects – Pine Point, Yellowknife City Gold, Colomac and Kennady Diamonds – are proving it to be true

Kerry Knoll says there are three niches in the mining industry: exploration, construction, and operation. “I never really liked exploration because your business plan depends on luck, and operation of mines isn’t that exciting for me,” says Knoll, who is the executive chairman and director of Pine Point Mining Limited. “So what I go for is the construction of a new mine.”

And how to find the best place? “To me the ingredients of a mine are many, but one of them is if there’s been a mine there before, you’ve got the best odds of having a mine in the future,” he says. He says the opportunity for that is often to look for a mine that produced a commodity that’s now out of favor, or a mine that is in receivership from the last bad mining cycle.

Following that philosophy, Knoll and his team began looking for a commodity down on its market luck. They settled on zinc about two years ago, says Knoll. “We predicted zinc prices were going to go up due to mine closures around the world, and it has turned out to be correct,” he says. “It was around 90 cents when we started negotiating, and right now it’s above $1.40.”

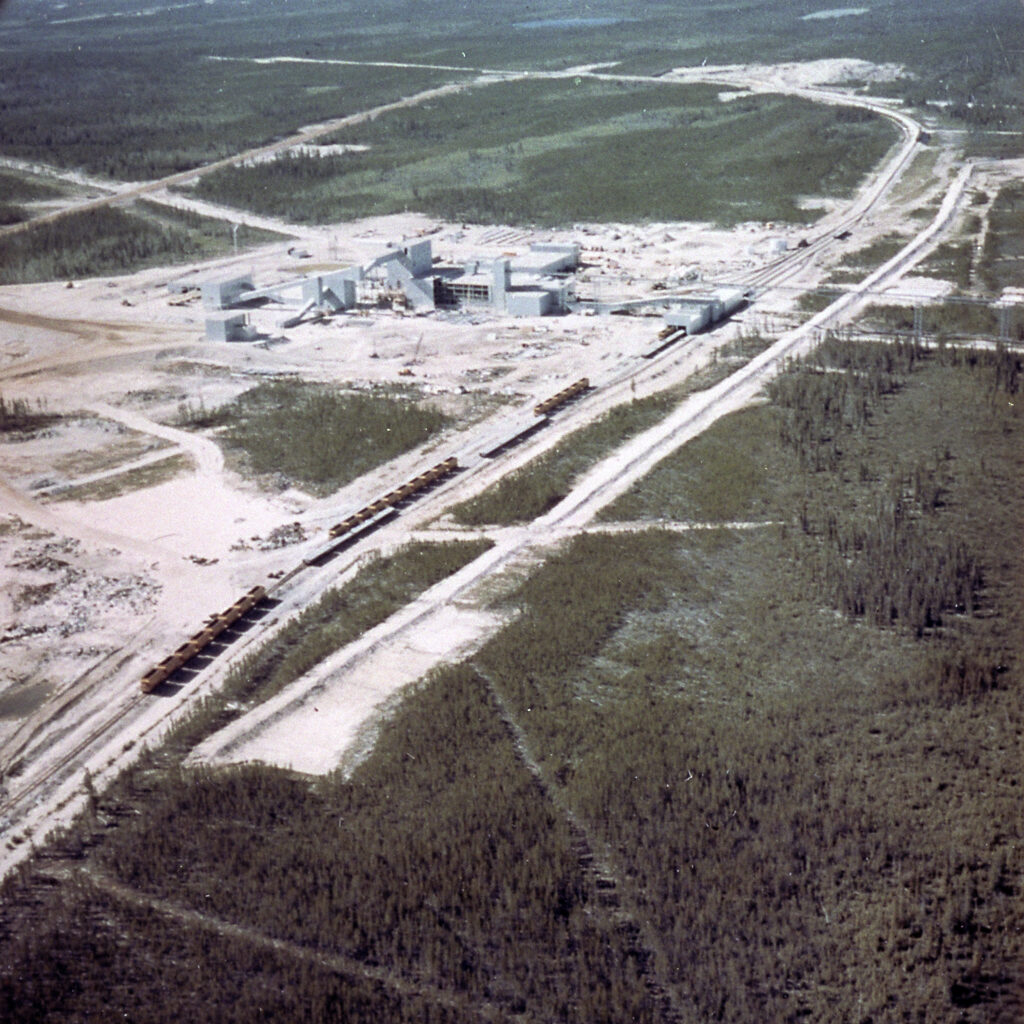

They looked at several projects and kept coming back to Pine Point. The 23,000-hectare Pine Point Lead-Zinc project, on the south shore of Great Slave Lake near Hay River, has a long history. Original owners Cominco began exploring there in 1929, ultimately discovering about 90 deposits. With federal government financial input of nearly $100 million, primarily to build the electricity and rail infrastructure, Cominco began large-scale production started in 1964, with reserves of 21.5 million tonnes averaging 4% lead and 7.2% zinc. From 1964 to 1987, 64 million tonnes were processed. But eventually Cominco found that 30 percent of its overall costs arose from maintaining the on-site town, built to accommodate miners and their families. Weak metal prices finally forced closure of the mine in 1987. Most of the buildings and infrastructure for both the mine and the town were dismantled and the site was abandoned.

Tamerlane Ventures bought the property in 2006, confident that strong lead and zinc demand would keep prices high. Tamerlane was so optimistic, it even completed a full environmental assessment for its project, but sagging global commodity prices played against getting to production. By late 2013, unable to pay its bills, Tamerlane was forced into receivership.

It was the opportunity Knoll needed. “Negotiating with the receiver took most of 2016,” he says. “But we raised the money and bought it in December, all in one fell swoop, for $8 million.” The purchase included all the mining claims and leases, a substation and power lines, haul roads, a paved highway, and the town site.

TerraX geologists explore the Southbelt holding near Grace Lake. Photo Courtesy of TerraX

Pine Point Mining completed a preliminary economic assessment in April 2017. It shows a healthy return with a relatively low capital cost, and over a 13-year mine lfe and an after-tax payback of 1.8 years. The study examined several scenarios and settled on a plan where ten open pit deposits could be developed using methods similar to those previously employed by Cominco. Concentrates could go south to market by train from Hay River, 50 km to the west. “We’re not looking at developing the old town site but certainly we will have a camp for about 80 people,” says Knoll. He expects that most of the needed 300- to 400-strong workforce will live in Hay River.

Knoll thinks they landed a winner. “Cominco discovered more than 100 deposits here,” he says. “They mined out 52 of them. There are 42 left on our property. And our preliminary economic assessment included only ten of those.” The company’s next steps include more drilling to confirm the extent of the resource, completing the feasibility study and starting the permitting process.

North from Pine Point, across Great Slave Lake at Yellowknife, TerraX Minerals is also looksing to capitalize on ready infrastructure, previously overlooked deposits, a bankruptcy, and the right point in a commodity cycle. Here it’s not zinc but gold.

“Our involvement started in 2012. There was a company that had gone bankrupt, Century Mining,” says Joseph Campbell, chairman and chief executive officer, who discovered the Meadowbank and the Meliadine gold projects in the Kivalliq region in Nunavut. “We looked at the properties, realized they were basically on strike with the two old mines (Con and Giant) so we decided to put in a bid and were fortunate enough to get it.”

An extensive study of Century Mining’s drilling records showed good promise. “Since that time we’ve selected various areas around Yellowknife to expand that so it’s actually quite a bit bigger than the initial bankruptcy,” says Campbell. TerraX owns the Yellowknife City Gold Project 100 percent.

The project consists of three properties encompassing 440 sq. km. on the prolific Yellowknife greenstone belt. It has 45 km of strike length, including the Northbelt property located along the same trend as the Giant Mine property (8.1 million ounces gold production over nearly 60 years) and the Southbelt property located along the same trend as the Con Mine (6.1 million ounces gold production over more than 65 years).

Campbell says two things drove their decision-making. “One is that it’s a good idea to look for more gold in places where gold has already been found. That’s fairly simplistic but still a valid exploration ploy,” he says. “The other thing I look for, and this is largely due to my years of work in the Arctic, is that infrastructure is just so important to be able to bring projects forward. And the Yellowknife project offers not only the great geology but also infrastructure second to none for a northern Canadian project. It’s right on the city doorstep and you can have all the services and supplies that you need to run a project at a fraction of the cost of most northern projects.”

Since the acquisition, TerraX has discovered previously unrecognized deposits. “We began our exploration out of the Northbelt, in a particular geology—the mafic volcanics—which had received the lion’s share of the historical exploration, and rightly so,” says Campbell. It’s where the ore mined at Con and Giant was hosted. “But we began to see significant mineralization in the other rock types in the belt, specifically the felsic volcanics and the sediments. We made a discovery in the sediments called the “Mispickel deposits” that woke us up to the fact that there were plenty of opportunities in those sediments that hadn’t been recognized.” So they staked a large block of ground next to a major crustal break and explored it intensively over the summer 2017 with some success. Campbell now views the project more as a district than a hunt for individual deposits.

Going forward, they’ll be digesting the summer exploration data, and planning a drill program for January that is budgeted for 12,000 metres of drilling.

Less than 200 km northwest of Yellowknife, another gold project is taking shape in the shadow of another bankruptcy – the Colomac mine.

Colomac operated between 1990–1992, and 1994–1997, first by Neptune Resources Limited, which had little success with mine profitability. Royal Oak Mines Inc re-opened it in 1994, but due to low gold prices and high mining costs, Royal Oak entered receivership in April 1999 and the site reverted to Aboriginal Affairs and Northern Development Canada (now Indigenous and Northern Affairs Canada) for remediation. That project concluded in Fall 2011.

“Colomac was known as low-grade, but I started looking and thinking there is lots of grade in this camp and it’s dispersed all over in different deposit types,” says Michael Byron, president and chief executive officer of Nighthawk Gold Corp. Byron has previous experience identifying such opportunities from his time with Lakeshore Gold and Falco Resources. “So in 2010, I said let’s stake the entire camp.” At the time the mine was still under remediation so he approached the federal agency responsible. “About a year later they contacted us about formulating a deal,” says Byron. By then, Nighthawk had staked everything in the camp, completely surrounding Colomac.They bought 100 percent of the mine and all the claims that were part of it in 2102. Any liabilities of the reclamation stayed with the crown.”

They found there were still over a million ounces left in the deposit. “The key factor (the previous operators) had missed was they didn’t know the geological model they were working with and that’s critical to any exploration,” says Byron. “Because you can then look for analogs around the world that have a history of mining and you can borrow and read the characteristics of that deposit and transpose it onto the one you are working.” He says after the very first hole Nighthawk drilled in 2012, they knew it was a differentiated mafic sill hosting gold, analogous to the rich Kalgoorlie camp in Australia.

“So from ‘15 and ‘16 onward we knew we had something to tell us that Colomac was more than a low-grade, open pit shallow resource, which it is, but these higher-grade domains also open up the possibility that you can ramp into the system.”

The advantage to hunting in the shadow of the headframe? “Finding things that others didn’t,” says Byron. “Not because they’re stupid, but often it’s the economics of the day, or corporate strategies.”

Three hundred kilometres east-northeast of Yellowknife, in the shadow of Gahcho Kué, the world’s newest diamond mine, sits the Kennady North Project. This one has some of the same ingredients as the other mines — infrastructure, new discovery potential, a good point in the commodity cycle. However, the one major difference is there is no associated bankruptcy. It was formed in mid-2012 as a spinoff from Mountain Province Diamonds Inc., itself a partner with DeBeers in Gahcho Kué.

Rory Moore, Kennady’s new president and chief executive officer, is no stranger to diamonds in the North. “I was involved as a consultant prior to the discovery of diamonds in the NWT,” he says. “And was involved with a partner in advising Chuck Fipke.” Moore also managed the Ekati project through to its feasibility study.

He figures Kennady’s location is a natural. “If you look at the map and see the kimberlites that have commercial diamond potential they follow that trend which we call the Kelvin-Faraday Corridor.” That corridor is a NE-SW structural feature that includes the Faraday and Kelvin kimberlites, and continues to the SW to include the Gahcho Kué kimberlites. “It is definitely a structural zone where high-grade kimberlites have erupted along,” Moore says. Six kimberlite bodies have been identified within the Kelvin-Faraday Corridor to date.

“Our first focus was Kelvin which we did last year and the focus this year is to get the Faraday into a resource,” says Moore. Faraday looks promising so far (See page 13). The 2017 bulk samples sent to WWW International Diamond Consultants in Antwerp for valuation revealed a collective average value of US$109 per carat and included a 7.78 carat diamond valued at US$2,967 per carat.

Moore reckons production costs will be similar to those at Gahcho Kué, roughly $55 a tonne, although the kimberlites are more unconventional. Gahcho Kué bodies are the typical carrot shape, but Kennady’s are smaller and more tubular. Preliminary mining studies suggest using a box cut style or open pit with steep sides on the back wall and the two sidewalls, Moore says. A smaller pit will need corresponding sizes of equipment such as smaller articulated vehicles to handle tighter switchbacks.

Moore sums up the advantages Kennady gains by shadowing Gahcho Kué. “Lots of companies have been successful with the theory of ‘close-ology’,” he says. “With it, you’ve probably got a better chance of finding something yourself.” Moore says Kennady benefits from two other positive circumstances — its proximity to Gahcho Kue is a result of its spinoff from Mountain Province, and Kennady’s land holding essentially surrounds the Gahcho Kué mine, so there’s a good chance any exploration that may lead to an expansion will happen on Kennady property. “From our perspective that is very attractive,” says Moore, “because the hurdle for actually achieving an economic deposit is significantly lower if you’ve got all the infrastructure in place right next to you.” MN