NUNAVUT

Mining and Mineral Exploration Overview

By Alia Bigio and Michal Russer, District Geologists, Nunavut Regional Office, Crown-Indigenous Relations and Northern Affairs Canada

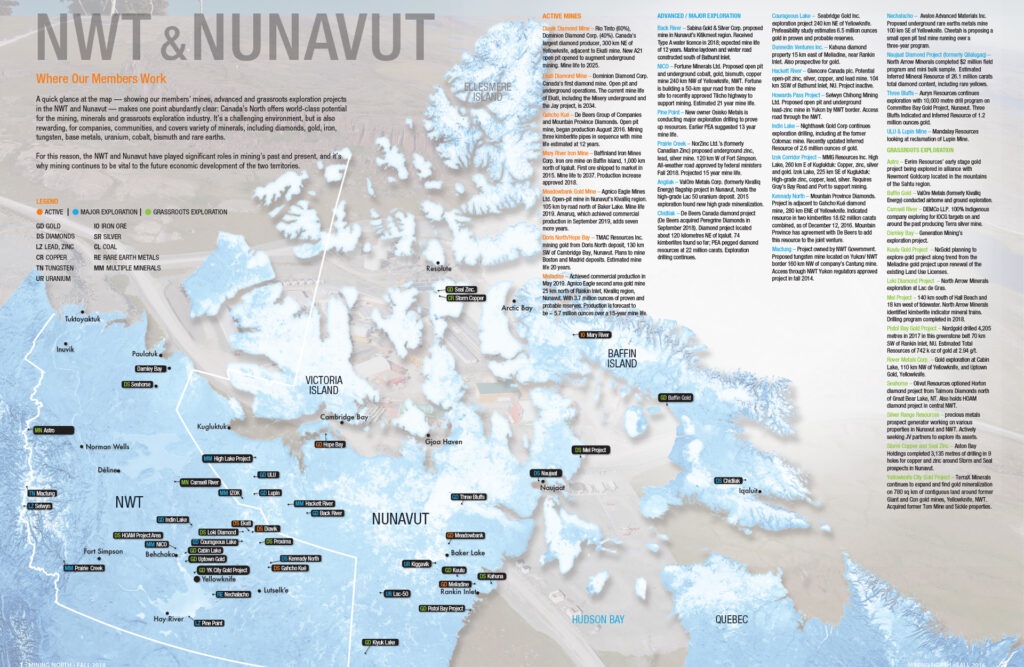

Nunavut continues to be an attractive jurisdiction for exploration and mining investment, with two new gold mines entering production. Work in the territory is mainly gold-focused, but recently reactivated diamond properties add some sparkle to Nunavut’s portfolio of projects, and the territory in general continues to have significant exploration potential.

Nunavut encompasses approximately 2 million square kilometres which accounts for approximately 20 per cent of Canada’s land mass. The territory’s geology is diverse, and includes a wealth of mineral resources; gold and iron are actively mined, and copper, zinc, diamonds, uranium, nickel, and rare earth metals have been both current and historical exploration targets. As of September 2019,

staked ground on Crown land across the three regions of Nunavut consists of 124 prospecting permits, 2,483 mineral claims, and 419 mineral leases totalling over 5.1 million hectares of tenure. In the 20 years since the territory was created, there has been over $4.3 billion in exploration investment in Nunavut.

Although exploration activity in Nunavut has not yet recovered to 2011 levels, the February 2019 release of the Fraser Institute’s Annual Survey of Mining Companies 2018 placed Nunavut at 15th in the world for investment, up from 26th place the previous year. Nunavut has four active gold mines: Meadowbank, Meliadine, Amaruq, and Doris, as well as one iron mine, Mary River. Although, the Meadowbank gold mine will cease production in Q3 of this year, ore from the Amaruq deposit is being trucked to the Meadowbank mill facility for processing. Commercial production at Amaruq commenced in September of this year.

Preliminary estimates for 2018, based on data collected by Natural Resources Canada, set the total value of metal commodities produced in Nunavut at $1.1 billion, of which $595 million was gold and $563 million was iron, placing Nunavut sixth in Canada. For mineral exploration and deposit appraisal expenditures in the territory, the preliminary spending total for 2018 was $149 million, up from the $110 million estimate, and spending intentions for 2019 are estimated at $144 million, placing Nunavut fifth in Canada. Gold topped exploration expenditures again in 2019, with an approximately even split between the Kivalliq and Kitikmeot regions.

Mining

Agnico Eagle Mines Limited (AEM) began commercial production at Meliadine on May 14, on time and under budget. AEM also achieved commercial production at its Whale Tail pit at the Amaruq project on September 30. A slowdown in the dewatering process for the Whale Tale pit led to a corresponding slowdown in drilling and mining activities, but the company was still able to stockpile 293,000 tonnes of ore grading 3.5 grams per tonne (g/t) Au. The reserves at Whale Tail and IVR will allow the company to sustain mining operations until 2024, and AEM is currently exploring underground options at Amaruq. Additional ore zones were identified in the Portage pit at the Meadowbank mine, pushing the planned shutdown of the mine to Q3 2019 with an expected production for the year of 95,000 to 105,000 ounces (oz) of gold.

AEM planned a $10.5 million exploration program, including 32,800 metres of drilling for 2019, focused on developing resources around the V Zone and Whale Tail deposits between surface and 600 m depth, as well as a regional program to further examine structural features in the area. An additional 20,300 m of conversion drilling, budgeted at $4.4 million, is also planned at Amaruq.

TMAC Resources, owner of the Doris gold mine, continued its development and exploration activities along the Hope Bay belt.

The company planned a $25 million exploration program including 60,000 metres of drilling across the belt for 2019, nearly doubling 2018’s target, and including 10,000 metres of drilling at Madrid North and 7,000 metres of regional exploration drilling.

Underground at the Doris mine, exploration continued on the Doris Below the Dyke (BTD) Extension zone. TMAC also approved the purchase of equipment necessary to develop the portal and decline at Madrid North, and the purchase and installation of a scavenger circuit in the ore processing facility, which should be complete by end of Q3 2019. Gold recovery declined slightly from 84 per cent in Q2 2018 to 80 per cent in Q2 2019. Gold production for the quarter totaled 38,520 oz. Exploration drilling highlights included 110.8 g/t gold over 10.8 m at the BTD Extension zone at Doris, 13.9 g/t over 13.65 m at Suluk, and 28.9 g/t gold over 0.39 m at Patch 7.

Baffinland Iron Mine Corporation operates the Mary River Mine and it’s located above the Arctic Circle on northern Baffin Island. Exploration in 2019 involved diamond drilling on Deposits 1 and 3 (both exploration and infill drilling), ground geophysics, sampling, prospecting, and additional staking. Baffinland applied to NIRB for permission to increase ore transportation capacity, and has begun construction on a second ship loader at the Milne Inlet port to facilitate any increase. The company is also seeking permission for construction of a railway from Deposit 1 to Milne Inlet to increase ore transportation capacity. Activities at the mine site included the official opening of a newly constructed 800-person camp in February. In April, Baffinland signed a Memorandum of Understanding with the Government of Nunavut, focusing on increasing Inuit employment, community wellness programs, as well as infrastructure and transportation.

Exploration

Sabina Gold and Silver continued exploration and development activities at Back River. The company closed a $5.2 million non-brokered private placement of 3.36 million flow-through common shares in April. The company’s 6,400 metre, nine-hole spring drill program focused on the Llama Extension zone, Umwelt and the Nuvuyak target, located approximately 700 m down plunge to the west of the main Goose deposit. Sabina has also been advancing development of the Back River project and the associated infrastructure. Supplies sealifted to the marine laydown area in 2018, including mining and construction equipment, were transported from the marine laydown area to Goose camp in April and May of this year using the 170 km seasonal ice road between Bathurst Inlet and Goose. In order to move the resources at Llama and Nuvuyak from Inferred to Indicated, an estimated 63,000 m of drilling would be required. Umwelt needs a further 6,500 m of drilling to further evaluate the potential for higher grade intersections in the existing corridor.

Auryn Resources completed a drill program on the Committee Bay project, with 3,000 m of diamond drilling on four targets identified with the assistance of

machine learning and geological observations. The program was planned to test targets on the Kalulik and Aiviq prospects. Auryn also completed ground-based induced polarization (IP) surveys on the 15 km Aiviq-Kalulik corridor. No results from the program have been released to date.

Solstice Gold Corporation’s wholly owned Kahuna Gold project, near Rankin Inlet, covers approximately 928 sq-km in the Kivalliq region. The company was spun-off in December 2017 from Dunnedin Ventures to investigate the gold potential of that company’s Kahuna diamond project.

The 2019 summer exploration program consisted of regional surface mapping, focused on the Enterprise prospect, followed by a planned drill program of eleven holes on seven targets. Three of the targets are magnetic anomalies, one is a strong electromagnetic (EM) conductor, two are intended to examine the stratigraphy and mineralization potential, and one is planned across the interpreted fold hinge of the Westeros fold structure. Previously the company collected a boulder sample from the Westeros area that returned 17 g/t Au. No results from the program have been released to date.

Silver Range Resources Ltd, a project generator company with several properties in the Kivalliq and Kitikmeot regions, optioned its Hard Cash and Nigel exploration projects to Canarc Resource Corporation in November 2018. In January 2019, Canarc announced completion of a 970 line kilometre airborne magnetic and radiometric survey over the Hard Cash property. To follow up on the results of the geophysical survey, the company planned a $200,000 summer field exploration program consisting of prospecting, detailed geological mapping, and sampling of the main high grade gold zone, as well as ground truthing some of the main geophysical and geological features of the property. The program was scheduled to commence in July.

ValOre Metals Corporation’s 100 per cent owned Baffin Gold property did not see any work this year, but results from last year’s field program were released in late 2018. The company announced that significant expansions were made to areas of gold-in-till anomalies, and a total of 6,984 km of airborne geophysics were completed, giving ValOre nearly complete coverage over 110 km of the Foxe Fold Belt. Highlights from the surface sampling program include 67.9 g/t and 29.2 g/t Au from the Durette quartz-arsenopyrite vein, and 46.4 g/t from the Brent quartz-arsenopyrite vein. Of the 31 rock samples collected during the program, 42 per cent assayed at over 5 g/t Au.

Margaret Lake Diamonds commenced exploration activities on the 59,000 hectare Kiyuk Lake gold project, in which it acquired an 80 per cent interest from Cache Exploration in February 2019. The company released a 43-101 report on the property in June, and in September Margaret Lake announced the deployment of survey and geological field crews to the property to conduct a review of historic drill core stored at site, to complete a field reconnaissance program, and to survey selected mineral claims in order to take them to lease. The program was still in progress as of press time.

There were no exploration activities reported for 2019 at De Beers Canada’s Chidliak diamond project, located approximately 120 km northeast of Iqaluit. De Beers announced plans to construct a mine on the property using FutureSmart Mining methods and technologies. The FutureSmart concept, developed by Anglo American, emphasizes clean energy, limited footprint, and minimized environmental impact. De Beers is also conducting

regular consultations with local communities. North Arrow Minerals’ Naujaat project, named after the hamlet located 10 km to the southwest of the property, consists primarily of claims covering the Q1-4 kimberlite complex. A population of rare Type IB fancy orangey-yellow diamonds has been identified in the kimberlite. In May 2019, the company began a study looking into the design and cost of a mobile diamond recovery plant to process a 10,000-tonne bulk sample from the Q1-4 kimberlite. In August, the Hamlet of Naujaat received a positive conformity decision from the Nunavut Impact Review Board (NIRB) for its plan to construct a 15-km access road from the hamlet that will pass close to the Naujaat kimberlite; this road, if constructed, would allow transportation of the proposed bulk sample to tidewater.

No field work took place at Naujaat or at the company’s other diamond project, Mel, but North Arrow released final results from an analysis of till sampling on the property. The North Mel kimberlite indicator mineral (KIM) target expanded by 750 m in width to 3,600 m, and the South Mel target returned an anomalous sample containing 15 indicator minerals, including chromium-rich pyrope garnet, eclogitic garnet, and magnesium-rich ilmenite grains.

Another diamond project, the 106,500-ha Stein property on the southern Boothia peninsula, was reactivated this season after being optioned by GGL Resources Corp. from Arctic Star Exploration Corp. GGL can earn a 60 per cent interest in the project by discovering in situ kimberlite on the property. The company completed a ground geophysical survey over the four permits making up the tenure, and announced in August that they had discovered a number of promising magnetic anomalies on the property. Previous work on the property includes geochemical analysis on kimberlite indicator minerals, which returned results indicating their chemistry could be favourable for diamond content. The Hood River gold project also saw renewed activity this year. Blue Star Gold Corp., formerly WPC Resources Inc., began a late season drill program at the site in early September, focusing on known gold occurrences on the property. A 2,000 m drilling program is planned for the North Fold Nose zone, to expand on historical work from the early 1990s, with surface sampling and mapping concentrated on the areas around the Bizen and Apex veins. Further drill targets will be generated from this sampling program. MN